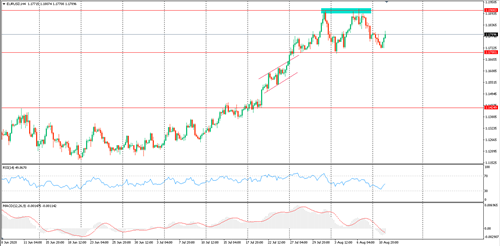

EURUSD

This pair is still trading within a limited range between the support level of $1.1700 and the resistance of 1.1900. On the upside, any bullish momentum above the resistance level mentioned will see the pair meet an immediate resistance at 1.2000-1.2050. On the downside, breaching the levels of 1.1700 could make the pair vulnerable towards 1.1600.

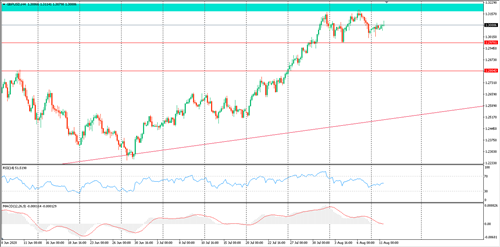

GBPUSD

The cable is currently trading within a bearish channel between the levels of $1.3200 and 1.2980. If it breaks through the support line of 1.2980, the pair could edge lower towards 1.2800. On the upside, any follow-through above 1.3200 may see the pair face an immediate resistance level at 1.3350 and then 1.3500.

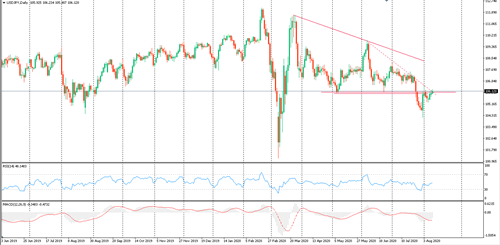

USDJPY

This pair tried to hold above $106.00, but failed to stabilise above it. It then edged lower and expectations are for more bearish momentum towards 105.00 and then 104.50. However, if the pair continues to stay above 106.00, we expect it to rise to target 108.00 / 108.50.

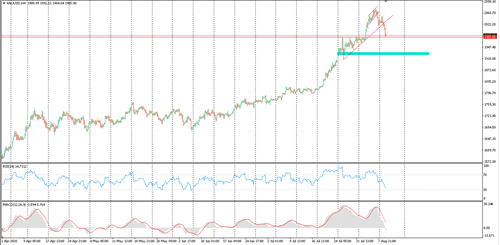

Gold (XAUUSD)

The yellow metal continued its decline from yesterday's session and broke the support of $1994 until it reached 1980. If the bullion maintains its grounds above the support level of 1980, our expectation is for gold to rise and get back to 2000 then 2014. However, if it fails to do so, we expect further declines to 1930-1920.

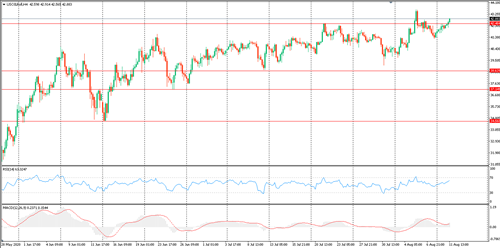

WTI (USOILROLL)

Oil was able to push above $42.50 a barrel once again so our expected targets for oil are 44.00 and then 46.00. If the black gold falls below 42.50, further declines could be expected to 40.00 and then 38.50

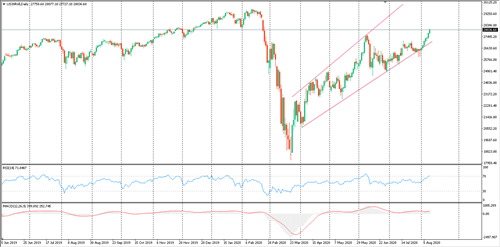

Dow Jones

The US industrial index achieved our expected targets of 27600. If it can break through this level, our expectation would be a further rise towards 29000 points. The support level on the downside is 27000, and if the index faces bearish momentum below it, the next support will be at 26000.