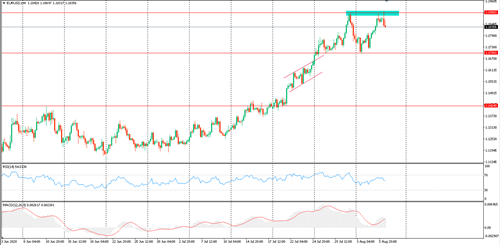

EUR/USD technical analysis

This pair tried to break through the 1.1900 resistance barrier but failed to do so and retreated from it. We expect it to retreat to 1.18 support levels, and if it breaks this, the decline may continue to the 1.1700 support level. In case of a rise to surpass the 1.19 resistance level, we may target 1.20-1.2050.

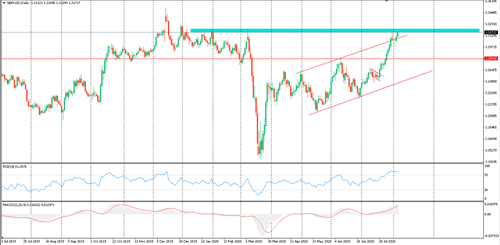

GBP/USD technical analysis

This pair faces resistance at 1.3200 levels. We expect it to test this level, and if it succeeds in overcoming it, we may target resistance at 1.33, then 1.35. If the price falls below 1.3200 levels, we may retreat to test 1.3000 support. If it breaks through this, the decline may continue towards 1.2800.

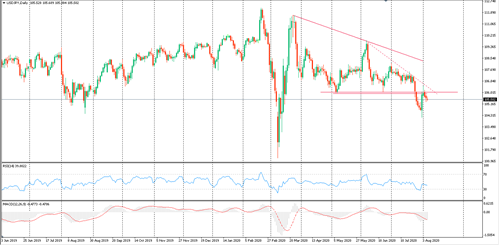

USD/JPY technical analysis

This pair tried to stabilise above the 106.00 level, but retreated below it, and we expect the decline to continue to the support levels of 105.00 - 104.50. On the other hand, if it remains above 106.00, we would expect it to target 108.00 / 108.50.

Gold technical analysis

Gold’s performance has been strong during recent sessions, and it has recorded its highest level at 2055, which represents the price resistance now. By breaking through it, we expect continue the rally to target 2100 as a short-term target. Support levels are at 2040-2028.

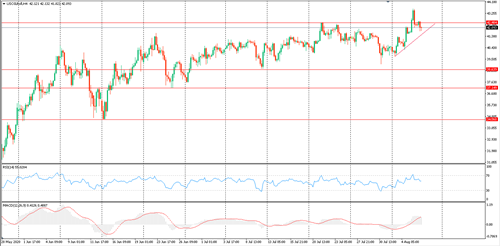

Oil technical analysis

Yesterday, oil surpassed $42.50 and peaked at 43.60 levels, but the price retreated below 42.50 levels again. Our expectations are, if the price remains stable, above 42.50 levels, we may target levels of 44.00, then $ 46.00. But if the price remains below 42.50 levels, we may see a decline to 40.00 levels, then 38.50.

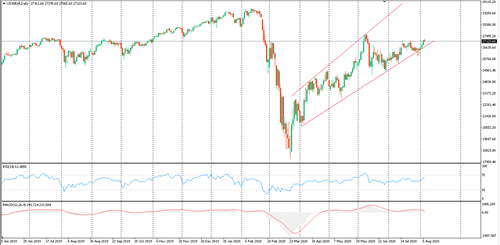

Dow Jones technical analysis

The Dow Jones reached its expected target at 27200 points, and we expect it to cross this level to target 27600 then 29000 points. If the price breaks the 26000 level, it may target the next support at 24900 points.