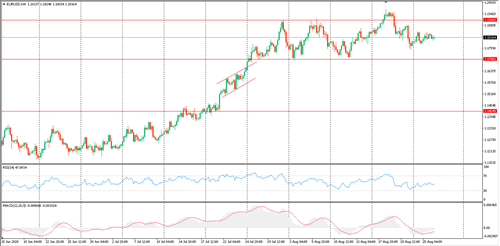

EURUSD

This pair tried to surpass the upper bound of the cross-region of $1.1900.

However, it failed to stabilise above it and retreated below it into the cross-section between the levels of 1.1700 and 1.1900.

If the pair rises and surpasses 1.1950 resistance, we may target 1.20-1.2050 levels. Support levels are 1.1750 - 1.1700.

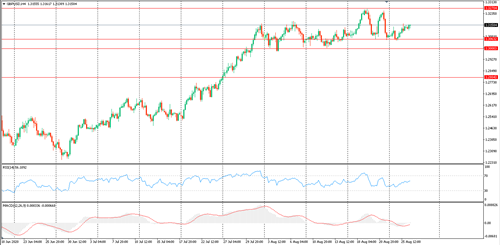

GBPUSD

This pair retreated to the support level of $1.3060. Our expectations are that if it maintains this level, the pair could rise and test 1.3270.

However, our outlook will change if the price breaks the 1.3060 and 1.2980 support levels, when the pair could drop to 1.2900 / 1.2800.

USDJPY

This pair is still moving within the descending channel's range on the daily frame, and it may face resistance at 107.00. If it succeeds in surpassing this level, it may target 107.60, which represents the upper bound of the descending channel.

The support levels of the pair are 105.00 - 104.00 - 103.50.

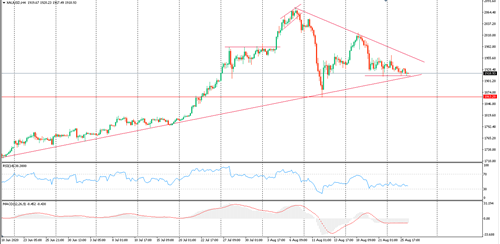

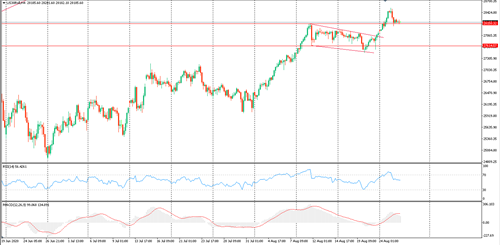

Gold

Gold is moving between $1911 support and 1956 resistance. We expect a break of the 1911 support level to target 1900, then 1860. By crossing the 1956 resistance, we expect to rise to the next resistance at $ 1990 levels.

Gold is currently facing weakness in performance that may affect it with a corrective decline, but the general trend is still up.

WTI

Oil reached its expected target of $43.50, but retreated from it, and we expect that if it remains below it, we may retreat to support levels of 41.70. If this is broken, it may target 40.50 - 39.00. If it surpasses 43.50 resistance, we might target 45.00 - 46.00.

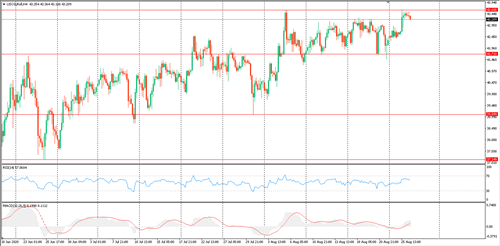

Dow Jones

The Dow Jones succeeded in overcoming 28150 resistance and rose to 28500. It is now retesting the 28150 level, from which a rebound is expected to target 29,000 points. Support levels for the index 28150 then 27450, which by breaking it, we may decline to 27000 levels.