In few hours, everyone will be watching two major events, including the European Central Bank decision, in addition to the ECB Chairman Mario Draghi Press Conference.

The ECB decision will be announced around 15:45 Dubai Time / 11:45 GMT+, while the press conference is expected to begin at 16:30 Dubai Time / 12:30 GMT+.

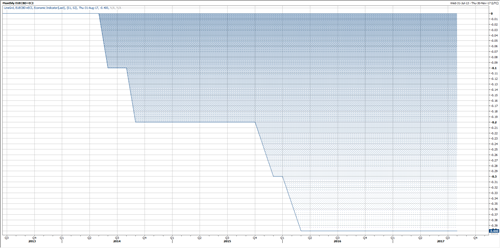

Looking at the most recent surveys, the estimates points to no change. The Minimum Bid Rate is expected to remain at 0.0% and the Deposit Rate at 0.0%.

However, there are mixed estimates about the ongoing QE programme. Some are anticipating another round of tapering of 10B euros, which brings the ongoing asset purchases down to 50B Euros down from 60B Euros.

Possible Scenarios

Amid the recent economic developments across the Euro Area countries, including inflation, growth the rest of the economic activities, the ECB is not in a position to keep things unchanged at least until the end of this year. Therefore we suspect three possible scenarios for today’s decision.

No Changed With Time Set: The ECB might be able to keep the current policy unchanged in today’s meeting. However, they might do the same as they have done back in December of last year, when Mario Draghi said that the tapering will start as early as March of this year. However, Mario Draghi might set a new date for further tapering, if they decided not to go ahead with it in today’s decision.

Deposit Rate Hike: Despite the fact that there is only a slight possibility to hike the deposit rate, but this might be reasonable. The deposit rate is at -0.4%, raising it by 10bps wont have a major effect on the economy anytime soon, but might be needed now before inflation starts to accelerate faster.

Tapering By 10B Euros: So far, the estimates for such scenarios is minimal, but it looks like the Euro is still pricing in some measures by the ECB today, as the Euro is still on the rise since the beginning of the day with more than 0.5% so far, nearing 1.20 resistance area.

EURUSD Technical Outlook

The Euro is currently trading around 1.1980, nearing its 1.20 barrier, which should be watched very carefully over the next few hours.

In the meantime, the bullish outlook remains very strong. At the same time, it looks like today’s decision is a win-win situation for the Euro, whether they left the current policy unchanged with a time set, tapering the current QE or raising the deposit rate.

Yet, 1.20 remains a solid barrier, while a break above that resistance would clear the way for another high, possibly above 1.21 with a possibility to test 1.2170, as there is no solid resistance between those two levels.

At the same time, If the failed to break higher, another leg lower could be seen. Yet ,its likely to remain limited above 1.1860’s, which held for the past two weeks as a solid support.

Even if the Euro failed to hold above 1.1867, the general outlook for the Euro remains bullish, as long as it continues to trade above 1.1650.

Edited by:

Nour Eldeen Al-Hammoury

Market Analyst